According to entrepreneur.com, accounting consultants are the number one most sought-after types of consultants. Becoming an accounting consultant takes a special set of skills beyond your technical accounting expertise. Technical skills aren’t necessarily the divide between a great consultant and a mediocre one. Passion, drive for excellence, leadership, communication skills, and organizational skills – in addition to your knowledge – play a big role in how successful you will be as an accounting consultant. While there are similarities, the primary difference between advisory services and accounting consulting is the length and purpose of the engagement.

What do accounting consultants do?

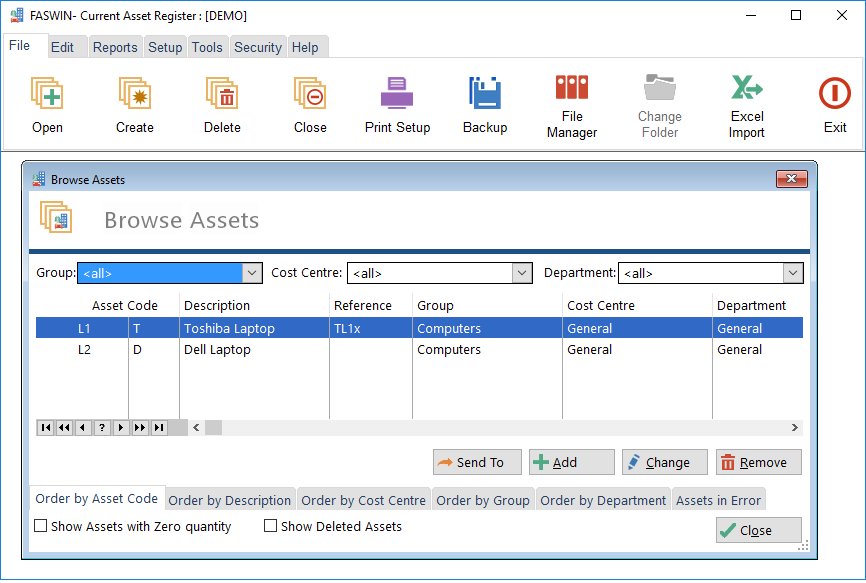

When selecting an accounting consultant for your business, it is important to consider their qualifications and experience. It is also important to ensure that they are familiar with the specific accounting software your business uses. The free software lets you generate an unlimited number of estimates and invoices and customize them with your business logo. Wave can also generate the most important financial statements (profit and loss, balance sheet and cash flow statement) along with reports on sales tax, payroll, aged receivables and aged payables. Free accounting software helps small businesses keep track of where their money is coming from and going to. The best options cover the basics in some combination of features, including double-entry accounting, income and expense tracking, invoicing, online bank connections and third-party integrations.

Cons of Being an Accountant Consultant

Staying abreast of these changes and ensuring that businesses adhere to them can take time and effort. They work closely with businesses to set realistic financial goals, optimize the use of resources, and develop strategic plans for future financial activities. Department of Labor’s Bureau of Labor Statistics, the unemployment rate for accountants and auditors was 1.4% in the fourth quarter of 2019. Let’s examine the definition of how puerto ricans are fighting back against using the island as a tax haven and describe exactly what accounting consultants do, how to become an accounting consultant, why you should consider making the switch, and much more. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

Accounting Manager

- In a fiercely competitive landscape, an additional degree can add significant weight to one’s credentials.

- Of course, you must begin by getting your accounting degree and becoming a Certified Public Accountant (CPA).

- With generative AI, the response time from concept to message has been reduced to under 72 hours, allowing the firm to be first to market with new concepts within its competitive peer group.

- An accounting consultant ensures that businesses adhere to financial regulations, conducting regular audits and helping prepare for external audit evaluations.

- Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Many small businesses and startups reach a point where hiring expert accounting help is needed. But even in a large corporation or venture capital or private equity firm, additional accounting expertise might https://www.kelleysbookkeeping.com/ be needed for an important project, initiative, or a merger, acquisition or divestiture. In many of these cases, hiring an accounting consultant or CPA consultant is a smart and cost-effective strategy.

What are the challenges of being an accountant consultant?

With a fixed consulting fee, you charge for your value, above and beyond your time. Your clients pay you for your expertise, knowledge and guidance, and you will likely reap the rewards of that relationship in terms of more business from them and their referrals as well. In addition, prior to the global pandemic, client expectations were already shifting. The future CPA is one who provides consulting services through an advisory lens – offering more than compliance work and serving as a more holistic business partner. If you’re wondering how to transition into accounting consulting, you’re in good company. It’s fairly common for CPAs to become part-time or full-time consultants just prior to retirement, while others enjoy the benefits of greater flexibility and control over their schedules earlier in their careers.

Our consulting services courses are led by seasoned experts that teach you how you can best serve your target clients. With various content formats available 24/7, you can take our consulting services CPE courses whenever and wherever it makes sense for you. CPAs, you know you’re required to earn a set number of Continued Professional Education (CPE) credits each year to maintain your license. Completing one of Becker’s Consulting Services Libraries would satisfy these requirements and bring you closer to where you want to be in your consulting work.

This necessity for lifelong learning can be challenging but crucial for continued field success. An accountant consultant’s role varies depending on their area of specialization https://www.online-accounting.net/multi-step-income-statement-multi-step-income/ and their clients’ specific needs. For most, this begins with earning a bachelor’s degree in accounting or a related field, such as finance or business administration.

The R&D tax credit can soften the financial impact of integrating generative AI, providing peace of mind and the fiscal courage to invest in what could very well be the defining technology of the next decade. The confluence of generative AI’s boundless potential and the strategic application of the R&D tax credit can be a game-changer for businesses willing to lean into innovation. Strong feature set includes thorough record-keeping, invoicing and advanced inventory management and pricing rules. Accounting software helps you track how money moves in and out of your small business. The best accounting software makes it easy to keep a detailed financial record so that you’re ready come tax season. It also includes tools for streamlining accounting tasks, like the invoice process, and gaining insight into your business’s financial health.

They compile detailed financial reports and explain their findings to executives and key stakeholders. Their insights can influence business decisions, strategies, and growth plans. Accountant consultants are well-versed in deciphering financial data to assess a company’s financial health.

To make costs even more palatable, many automation and AI projects can qualify for Section 41 R&D credits, which can be used to offset development costs. While waiting for more certainty and lower costs is always an option, firms with disposable capital have jumped in as early adopters of generative AI. The Fortune 500 and big businesses seemingly have unlimited funds to invest in automation and AI solutions, but most businesses must be budget conscious.

Our partners cannot pay us to guarantee favorable reviews of their products or services. To become an accountant consultant, you need a solid educational foundation in accounting, professional certifications, practical experience, and a diverse skill set. Finding a specific industry or service to specialize in can help set you apart in the market.